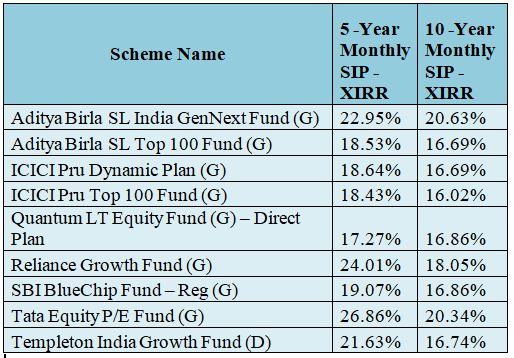

Top 10 Mutual Fund Schemes suitable for SIP investment in year 2022

Types of SIPs

1. Top-up SIP

This SIP allows you to increase the SIP amount at regular intervals and take advantage of a well-performing mutual fund scheme by increasing your investment amount. For example, if your SIP is Rs 10,000 per month in June 2019, you can increase it to any amount, say Rs 11,000 per month in July 2019 or any other succeeding month under Top-up SIP

2. Flexible SIP

This SIP allows you to increase or decrease the SIP amount as per your disposable income. Thus, with this SIP, you can decrease or skip the payment of a few installments when there is a cash crunch. Similarly, this SIP also allows you to increase the SIP amount during an increase in cash inflows

3. Perpetual SIP

While making a SIP investment, investors have a choice to provide the end date of the SIP. If the investor chooses to not given an end date then it is a perpetual SIP. This allows you to end your SIP at the time of your choice or when your financial goal is achieved since there is no fixed tenure attached to the SIP

4. Trigger SIP

This SIP is suitable for investors who have knowledge and awareness of financial markets. It allows you to set either an index level, NAV or a particular date as the start date of the SIP. However, it is not advisable to invest via a trigger SIP as it is essentially an attempt to time the market which is nearly impossible to do with 100% accuracy

How is NAV Calculated?

For example, let’s say you set up a Rs. 1,000 monthly SIP plan for 12 months starting from the 7th of the month. Every month around the same date, your bank account will show a Rs. 1,000 deduction towards investment in the mutual fund of your choice.

The case of applicable NAV is based on whether the 7th is a day when the markets are open or closed. If the 7th is a working day for the stock market, the applicable NAV for your SIP installment would be the chosen mutual fund’s NAV at the close of markets on the 7th. If 7th is a holiday such as a Saturday, Sunday or Public Holiday, then the applicable NAV would be the one obtained at the end of the next working day.

How to Choose SIP?

While choosing the SIP plan, there are many different aspects that should be kept in mind. However, if one wants to invest on SIP, here are some of the important points that should be considered.

- Duration of SIP

For how long one wants to invest in SIP matters a lot from the perspective of tax, risk, and returns. It is always suggested to invest in Sip for a longer tenure in order to gain the maximum return on investment. Before zeroing in on the SIP plan it is important to consider 5 years reference point and check the performance of the fund across markets.

- Fund Houses

While choosing the SIP plan, it is very important to check the reputation of the fund house in order to know that whether the funds will be able to handle the market fluctuations without letting the investors face the loss.

- Rs.500 Cr Asset under Management

Rs.500Cr. asset size can be considered as an appropriate benchmark while choosing the fund. However, it doesn’t mean that the funds below this asset size are bad, but it may not perform as good as the funds above this asset size.

SIPs are not a risky investment, but the mutual fund scheme in which they invest could carry a greater amount of risk than an investor can handle.

3 SIP Investment Mistakes you should avoid

1. Investing Too Small or Too Big Amount

It is often observed that many investors invest a very small amount via a SIP. It is fine to begin with a small amount in the beginning, however, the investment amount should be gradually increased to reap in substantial gains. Similarly, many investors begin a SIP investment with considerably huge amounts. This approach must be avoided and huge sums must be invested once the investor has enough confidence about the performance of the fund. An investor should always try to invest an amount optimal according to their financial position and investment objectives.

2. Not Investing For Long Term

Investors often withdraw their investment as soon as it starts giving a decent return, failing to realise that the value of a SIP investment also depends on the SIP time period. A SIP investment is capable of giving its maximum returns over a long tenure. Thus, it is advisable to remain invested for at least 3-5 years in order to earn some real good returns.

3. Not Increasing SIP Amount with Time

Another mistake which investors often end up committing is they fail to increase the SIP amount with time. With an increase in disposable income, an investor should increase the SIP contribution in order to continue receiving inflation-beating returns. This must be done when an investor is confident about the fund’s performance.

Disclaimer: The recommendations and reviews do not guarantee fund performance, nor should they be viewed as an assessment of a fund’s, or the fund’s underlying securities’ creditworthiness.