The following are the process of getting your Free CIBIL report online:

1. Visit Official CIBIL Page

In this page you will be asked to create a Username and Password with your personal information related to

- Name

- Telephone Number

- Email Address

You have to fill information related to all the Fields are Mandatory, so you cannot skip anyone. Click I accept and continue to the next page.

2. The next page ask for details like

- Date of Birth

- Gender

- Full address with pin code

- Identity Proof (Pan Card)

After filling all details click on submit button.

3. This is the process of registration with the CIBIL. Once you complete registration, you will receive an Email on your registered email Id. You will get a one-time password for login to check your CIBIL Credit Score.

4. Go toMyCIBIL Login Page. The same link you get by email. You will reach the login page.

5. Fill your registered email Id, password (receive in email) and captcha. After submitting, you may ask to change your password. First, change your password and again login with the new password.

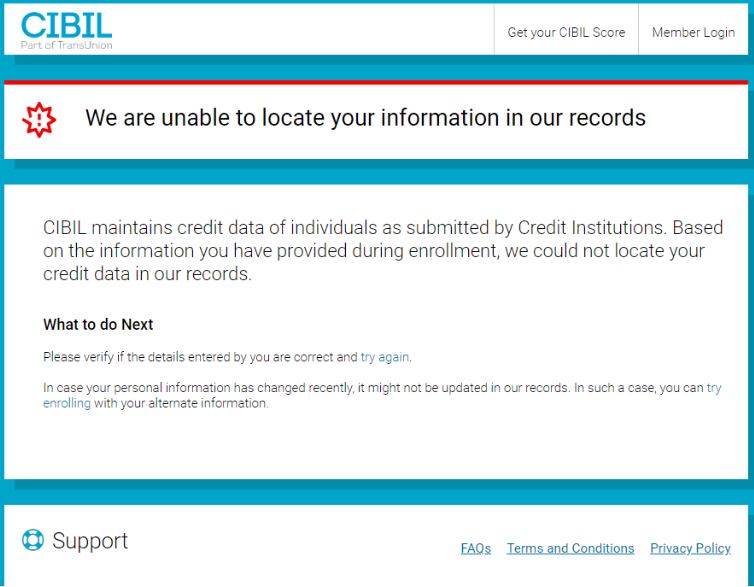

6. Once you log in, then you will get the below home screen where you will notice your credit score. Incase if you have no credit history or -1 CIBIL your report may look like the following image.

7. If you have credit history your CIBIL Score will be somewhere between 300-900 as shown below

Other Related Blogs

What creates a good CIBIL Score?

If your score is in the “good” range in the chart, you’ll generally be able to qualify for a mortgage loan with a competitive interest rate. The best rates are reserved for top-tier buyers, but the difference in interest rates between good and excellent credit scores may be less than you think.

https://www.omozing.com/2021/04/20/what-creates-a-good-cibil-score/

CIBIL Score-Myths

CIBIL aims to bring in more transparency to the loan approval process in the country, in that customer now have an understanding of the seminal factors which lenders analyse to gauge creditworthiness. CIBIL reports, generated on a monthly basis (as mandated by the RBI), help lenders evaluate and approve or reject loan applications, as the case may be. However, there are several myths associated with CIBIL which need to be busted.

https://www.omozing.com/2021/04/20/cibil-score-myths/

How CIBIL Score Is Calculated?

While each credit information company has its own proprietary algorithm to calculate an individual’s credit score, the most important elements of the score composition are centric around the loan payment behavior of the individual. Your CIBIL TransUnion Score is calculated based on the information in the “Accounts” and “Enquiry” section of your CIBIL Report. The score is calculated based on the following factors – an overview:

https://www.omozing.com/2021/04/20/how-cibil-score-is-calculated/

All about CIBIL Score

If your score is in the “good” range in the chart, you’ll generally be able to qualify for a mortgage loan with a competitive interest rate. The best rates are reserved for top-tier buyers, but the difference in interest rates between good and excellent credit scores may be less than you think.

https://www.omozing.com/2021/04/20/all-about-cibil-score/

All about CIBIL Defaulter

Any individual who has ever been on the credit line gets a report automated in the credit bureau together with information on the repayment timings. When repayments are late or not made at all, it has a negative impact on your credit score.

https://www.omozing.com/2021/04/20/all-about-cibil-defaulter/

Bad Credit Score – Side effects

Consider your credit score as the financial scorecard that ranges from 300 to 900. The score is given based on your loan or credit card repayment track of at least 6 months to a year. Any score of 750 or above is considered a good one while a credit score below 600 is considered bad by lenders.

https://www.omozing.com/2021/04/20/bad-credit-score-side-effects-3/

Top 10 FAQs about Credit Score – good to know in 2021

CIBIL is not authorized to make any changes to an individual’s report unless approved by a bank or financial institution. CIBIL can, therefore, only help facilitate the process.

https://www.omozing.com/2021/04/20/top-10-faqs-about-credit-score-good-to-know-in-2021/