On March 27, the Reserve Bank of India (RBI) said that all lending institutions, including banks and housing finance companies, will have to give its borrowers a three-month moratorium on term loans. The moratorium was for payment of all instalments falling due between March 1, 2020 and May 31, 2020. According to the RBI, the deferred instalments under the moratorium will include the following payments falling due from March 1, 2020 to May 31, 2020: (i) principal and/or interest components; (ii) bullet repayments; (iii) equated monthly instalments (EMIs); (iv) credit card dues.

If you do not pay the next two EMIs of your loan, you will not be blacklisted. But the bank will charge interest for the unpaid amount. Missing two instalments could extend your loan by 6-10 months or increase EMI amount by 1.5%

Who can avail?

RBI has included all term loans dues under the moratorium. Term loans include vehicle loans, home loans, personal loans, and agricultural loans or any other credit which has a fixed tenure.

Will borrowers get an interest waiver?

No. Interest shall continue to accrue on the outstanding portion of term loans during the moratorium. The interest due during the period of the moratorium will get added to the customers’ outstanding amount and will only increase their loan burden.

Therefore, it is advisable that one should opt for it only if they are facing a liquidity crunch, else it’s better to continue paying the EMIs.

Will availing the moratorium impact the credit score of the borrower?

No, it will not impact the credit score since banks are not going to be allowed to classify the loan as a non-performing asset (NPA). Banks will not be able to report any default on this count to the credit bureaus.

Options by Lenders

Option I: The borrower can make a one-time payment in June of the interest that accrues in April and May.

Option II: The interest is added to the outstanding loan which will increase the EMI for the remaining months.

Option III: The EMI is kept unchanged but the loan tenure is extended. The number of additional EMIs will depend on the age of the loan.

Let us assume a borrower took a home loan of Rs 50 lakh at 9% for 20 years. The EMI comes to Rs 44,986. If he wants to skip the next two EMIs (April and May), here’s how the moratorium will impact his repayment schedule.

Clearly, the longer the remaining tenure, the bigger is the impact. This is because the interest accounts for a larger portion of the EMI in the early years and progressively comes down. Even after the first year, the interest accounts for almost 80% of the EMI. But in the 19th year, the interest portion is less than 10% in the EMI.

So, people with older loans taken 10-15 years ago will not feel the burden as much as someone with a new loan taken 2-3 years ago. Ironically, people with older loans may not really need the moratorium as much as those with younger loans.

Go for the deferment plan only if there is a dire need. Otherwise, if you have sufficient resources and can pay the EMI, don’t opt for the moratorium.

What is the burden on the customer who opts not to pay for three months?

The burden will be higher if a customer is at the beginning of the loan cycle since the principal outstanding is higher and vice- versa. (See chart)

Process for the customer to apply for the EMI moratorium

If the customers do not want to opt for a moratorium, they don’t have to do anything. But if they are going ahead with it, then the customers will have to inform their banks.

For instance, HDFC Bank customers who want to defer their EMIs can fill the form available on the bank’s website or they can call at 022-50042333, 022-50042211. However, the SBI customers have to draft an email and send it to the bank informing it about their decision. ICICI customer can opt for the moratorium by clicking on the link shared with you by the Bank through (i) SMS or (ii) e-mail. You may also visit ICICI Bank’s website www.icicibank.com

Does moratorium apply to Credit Card dues as well?

Credit card dues will also be eligible for the moratorium. However, interest will be charged by the credit card issuer on the unpaid amount. Generally, credit card companies charge a hefty interest of 36% to 42% annually in India. Besides, the interest rates on a credit card also attract an 18% Goods and Services Tax (GST).

Don’t avoid Credit Card Bill

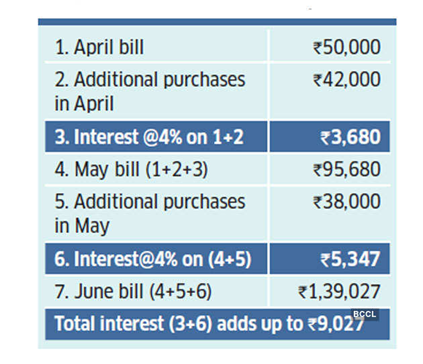

While your home and car loan can be deferred in case of a cash crunch, don’t even think of taking a moratorium for your credit card bill. The impact of deferment would be significantly bigger in case of credit cards because they charge a prohibitive 3-4% a month for rolling over the balance. If a cardholder doesn’t pay for two months, the cumulative interest could add up to more than 6-8%. The additional expenses charged to the card over the next two months will also attract interest. Worse, you will be charged interest on the interest not paid in the previous month.Non-payment will bloat up your credit card bill

Non-payment will bloat up your credit card bill

Interest is 2-4% a month on unpaid bill

If you have a fat credit card bill and don’t have enough liquidity, get the amount converted into easy EMIs. Card companies are willing to turn the outstanding amount into easy EMIs of 6-24 months. They will charge 12-18% on this, but that will still be lower than the 36-48% annualised cost of rolling over the credit card balance. You can also avail of a personal loan to settle the bill. At 18-24%, personal loans are not cheap but not as costly as rolling over the credit card bill.

Other Related Blogs

3 ways COVID-19 will change our Investments

This period was characterized by responses at two levels—to ensure that business continued as usual and to manage client expectations as markets turned extremely volatile and unpredictable.

5 Money Mistakes to avoid during COVID-19

Covid-19 has affected countries, global markets and individuals on varying levels. Many measures have been taken by regulators and governments in response to this crisis to ensure that their respective economies survive.

How to Save Money during COVID-19

The COVID-19 crisis has caused immense disruptions in our lives, not just to our jobs but to our health as well. Businesses have been forced to temporarily shut down to support efforts in containing the COVID-19 pandemic, with some even ceasing operations due to the huge losses incurred during the community quarantine.

Emotional Well-Being, Mental Health and Coping during COVID-19

The COVID-19 pandemic has had a major effect on our lives. Many of us are facing challenges that can be stressful, overwhelming, and cause strong emotions in adults and children. Public health actions, such as social distancing, are necessary to reduce the spread of COVID-19, but they can make us feel isolated and lonely and can increase stress and anxiety.

How to Restore Balance in Your Life after a Shaky 2020

Routines are a balancing act at the best of times but in the year of Covid, all the balancing was done on a knife-edge. You were confined to home but the office encroached on your personal time. Exercise, relaxation and recreation were sacrificed.

10 Good Things that happened in 2020

The COVID-19 pandemic killed more than 1.7 million people worldwide, an undeniable and at least partly avoidable tragedy. Millions were thrown out of work, although the world unemployment rate is still below where it was in the Great Recession; millions more sank back into poverty. The global economy, once expected to grow by 2.5 percent, shrank by an estimated 4 percent.

6 Ways to ensure Financial Wellness during COVID

The outbreak of covid-19 only made matters worse for the global economy, which was already juggling between many issues. You must take prudent financial actions, both preventive and corrective, to ensure overall you and your family’s financial wellness.

How to Save Money during COVID-19

Saving and paying your debts depends mainly on a few criteria which are: If EMIs interest rates are low then save money first before paying EMIs. Secondly, if your rate of interest is high then pay your dues first and then save money. Thirdly, check your income and spending together by making a proper budget plan, then decide how much cash you have.