Credit Score-Meaning

Credit Score is a three-digit number range from 300-900 that relates to how likely you are to repay debt. Banks and lenders use it to decide whether they’ll approve you for a credit card or loan.

Most people are not even aware of the credit scoring process until they apply for a loan! And then it dawns on to the small steps that could have been taken in everyday life to have a good CIBIL rating. But that might be too late as the person’s loan application would have already been rejected and he would be left on to a loan path to rebuilding or improving his CIBIL score.

There are totally 4 credit bureaus in India were you can pull your own free Credit report they are as follows:-

- CIBIL

- Experian

- Equifax

- High Mark Credit Information Services (CRIF)

1.TransUnion CIBIL

CIBIL or TransUnion CIBIL (Credit Information Bureau (India) Limited) is India’s oldest and most reliable Credit Information Company (CIC) that provides credit related services to its members nationwide. Since its establishment, in the year 2000, CIBIL has been collecting and maintaining credit information of Indian residents provided by banks and NBFCs. The credit bureau on the basis of the credit information of an individual, generates their credit report and credit score. The lenders on the basis of the credit report provided by CIBIL, analyze whether the applicant is capable of repaying one’s loan on time or not. This way, CIBIL performs an essential role in India’s financial system.

How to get Free CIBIL Score?

To get your credit report for free, follow these steps:

- Visit CIBIL’s Official Website.

- Fill out a form with below details for identity verification with CIBIL:

- Date of Birth

- Gender

- Postal Address

- Identity Proof Number (PAN, Aadhaar, etc.)

- Accept terms and conditions

Once you accept terms and conditions, CIBIL will show your Credit Information Report (CIR). You can get your full free credit report only once in a year.

2. Experian Credit Report

The Experian Credit Information Report is a compilation of your credit history. The data in the Experian Credit Information Report is based on the information provided to them by all our member banks, financial institutions and other credit grantors.

Experian has the following three steps which are online:

- Visit Experian Official Website

- First please fill the Free Experian Credit Report web form to get your Free Experian Credit application started

- Once you fill this, you should receive a Voucher Code in ~ 2 days and a link to your Email ID that would contain further instructions and forms to be filled online

Details Required

- Personal details form

- OTP verification

- User details form

- Q&A form

3. Equifax Credit Report

Equifax combines robust data, analytics and advanced technology to provide actionable insights to businesses, which in turn enable them to make sound decisions across customer acquisition, extending credit, mitigating fraud or better managing portfolio risk.

- In contrast, this one seems to be available on mobile only Google PlayStore– Android, Apple Store – iOS.

- Download the app for checking your Equifax Credit Report online and fill out few personal details with Aadhaar number to get your report.

4. High Mark Credit Information Services (CRIF)

CRIF High Mark is India’s full service credit information bureau which comprehensively covers credit information for all borrower segments MSME and Commercial borrowers, Retail consumers and Microfinance borrowers across the vast expanses (whether urban or rural areas) of our country. With one of the largest databases of individuals and businesses from over 3000 financial institutions, CRIF High Mark provides credit information services for and supports millions of lending decisions every month.

How can I check my CRIF High Mark Credit Score?

As per RBI guidelines the credit bureaus including CRIF High Mark are mandated to provide a free credit score once a year to individuals. Those who are interested in knowing their credit scores from the bureaus can visit the bureaus and apply for a credit report online or through post.

You can check your credit score and receive your credit report online. It is a fast and simple process and you will receive your credit score via email shortly after authentication.

While applying through post, you may be asked to furnish certain documents for verification and your report will be mailed to you upon authentication. You can also apply for it by post by sending a filled-in printed application form. Upon authentication of the details, the credit bureau will send you your credit score to the address listed in your address proof document.

- Visit CRIF Official Website

- Login with your login credentials or social media credentials or continue as guest.

- Fill out a form with below details with CRIF:

- Date of Birth

- Gender

- Identity Proof Number (PAN, Aadhaar, etc.)

CIBIL Login process

The following are the process of getting your Free CIBIL report online:

1. Visit Official CIBIL Page

In this page you will be asked to create a Username and Password with your personal information related to

- Name

- Telephone Number

- Email Address

You have to fill information related to all the Fields are Mandatory, so you cannot skip anyone. Click I accept and continue to the next page.

2. The next page ask for details like

- Date of Birth

- Gender

- Full address with pin code

- Identity Proof (Pan Card)

After filling all details click on submit button.

3. This is the process of registration with the CIBIL. Once you complete registration, you will receive an Email on your registered email Id. You will get a one-time password for login to check your CIBIL Credit Score.

4. Go toMyCIBIL Login Page. The same link you get by email. You will reach the login page.

5. Fill your registered email Id, password (receive in email) and captcha. After submitting, you may ask to change your password. First, change your password and again login with the new password.

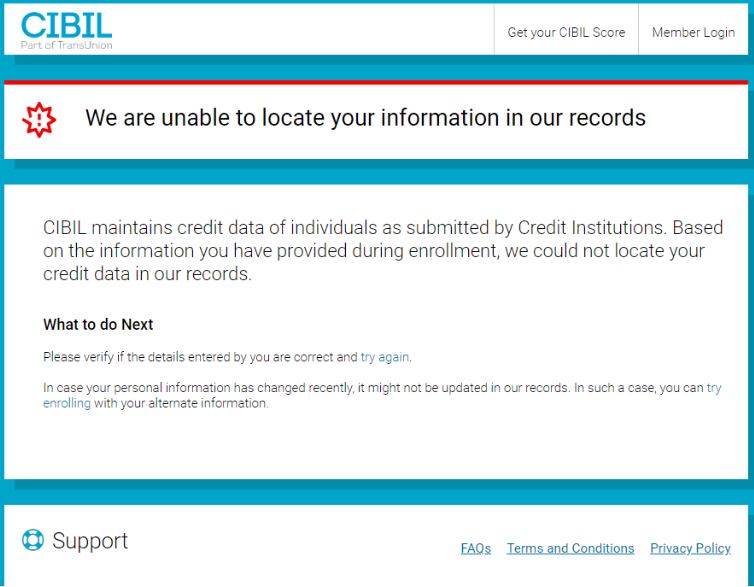

6. Once you log in, then you will get the below home screen where you will notice your credit score. Incase if you have no credit history or -1 CIBIL your report may look like the following image.

7. If you have credit history your CIBIL Score will be somewhere between 300-900 as shown below

CRIF Login process

The following are the process for getting your free Credit Report from CRIF:

1. Visit CRIF official website

2. Click on get your Credit Report now. A window asking for Email Id will appear you can also log in with Facebook /LinkedIn and click get my report.

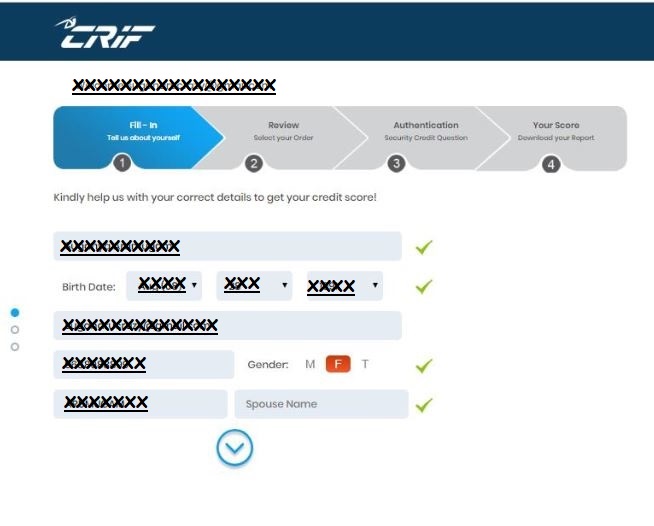

3. A screen asking for your Personal Details like

- Name

- Date of Birth

- Email Id

- Mobile Number

- Gender and

- Father/Spouse Name

Enter all the fields as they are mandatory and click next as shown in the figure.

4. The next page asks for your identification number where you can enter your 10digit PAN number and click next.

5. Enter you complete address with the CAPTCHA and click submit.

6. You will receive a window as below

7. A Mail with your Credit Report will be sent by CRIF to your Email ID which looks like the below image if you don’t have a credit history or if your Credit score is -1.

Equifax Login process

Equifax Credit Score can be obtained only through app.

1. Download our Equifax App from Google Playstore or the iOS App store

2. Login to the Equifax App – Provide your email address to receive your temporary pin

3. Login using your email and temporary pin to create a 6-digit login sent to the mail id through which you have registered Equifax account. Create your desired 6 digit pin for future log in.

4. Log In with the newly created 6 digit pin again to proceed with the process.

5. Fill your KYC details to proceed further.

Provide your personal information like

- Aadhaar Name

- Mobile Number

- Date of Birth

- Aadhaar Number

After your information is confirmed, a one-time password will be sent to your Aadhaar registered mobile number

6. Enter your OTP in the Equifax App

7. Once authenticated successfully, your password protected credit report will be sent to your registered email address within 24-hours after the successful completion of KYC verification.

Experian Login process

The following are the process of getting your Free Experian credit report online:

1. Visit Official Experian website

In this page you will be asked to create to enter your

- Name

- Email Id

- Mobile Number

OTP will be sent to the given mobile number. Enter the OTP and .proceed to the next page as shown in the above image.

2. On this page please enter your personal details like

- Date of Birth

- Gender

- PAN Number

- Full Address

- Pin code

Click on Get Report to proceed to the next page.

3. If you have no credit history or your credit score is -1 your credit will look like the below image.