One of the most common ways to pay money is through a cheque. Writing a cheque is really easy, but you must be careful. A mistake while writing a cheque, can prove very costly and cost you a lot of money.

1. Use ‘A/C Payee’ instead of ‘OR BEARER’

Cutting the words ‘Or Bearer’ and writing ‘A/C Payee’ to the top left corner of the cheque will ensure that no one apart from the individual in whose favour this cheque is drawn can acquire the stated amount. In case you do not omit the words ‘Or Bearer’, it can be acknowledged as a Bearer cheque and any person possessing the cheque can claim the money.

2. Avoid Spaces

Always make sure that you do not leave spaces between the words PAY and the Name of the Receiver. Also, avoid leaving spaces between the name and surname. This practice is important since it doesn’t offer anyone a chance to fill in alphabets before or after the name to claim the money.

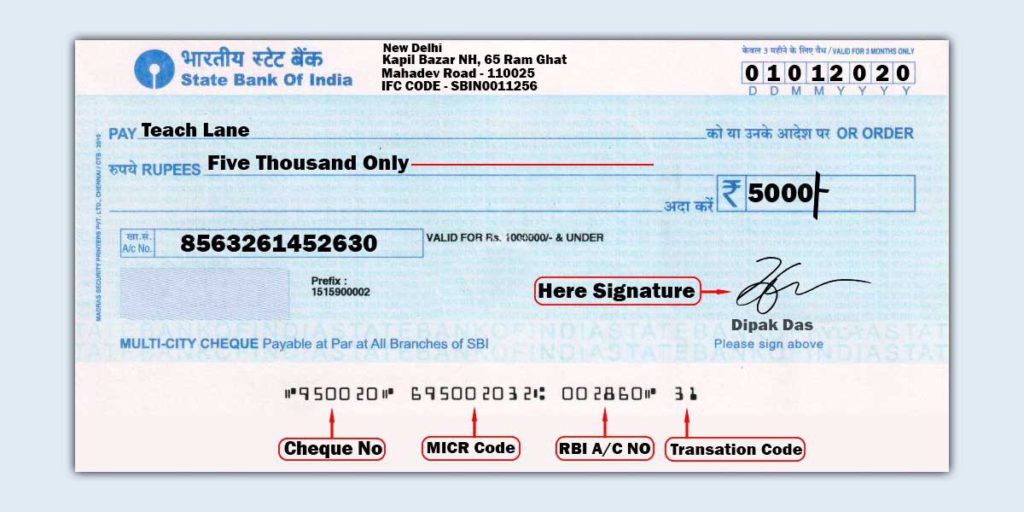

3. Don’t Sign On the MICR Band

MICR band is the bank’s related numeric at the bottom of the cheque. For everyone who is accessing the cheque mode of payment to manage transactions, it is quite crucial to know that signing in the MICR Band is considered as a WRONG practice. This is one of the prime reasons that can get your cheque defiled. Whenever you try to fill a cheque be careful to sign on the space provided right above the Name of the Account Holder or Authorized Signatory text.

4. Fill the Correct Date

Writing a cheque without adding the date can be a dangerous practice. This permits anyone to put any date and pull out cash using the cheque at their will. Further, a cheque with a post- or pre-date is another issue that can lead to dishonouring of the cheque. Moreover, a wrongly written date, for example, the wrong year or a month would also lead you in a problem.

5. Don’t Overwrite

When you are writing a cheque, make sure there is no sort of overwriting. It means, no scribbling or cancellation of text would be entertained by the banks. The person has to rewrite on a new cheque, if there is any overwriting mistake with the earlier cheque.

6. Keep records of your Cheques

It basically points to the careful preservation or proper maintenance of all your cheque records. One should manage a record of the cheque details comprising the cheque number, issuer name, and date for future safety reference. Do not forget to mention the payment amount with every cheque that is issued. Usually, cheque books do consist of a section for all such information at the extreme back. However, try to keep this information handy in order to avoid any kind of confusion, suspicious activity, or possible fraud.

Tips To Fill a Cheque Leaf Correctly

- Do not sign blank cheques. Always fill in the date, the name of the receiver and the amount before signing the cheque.

- Remember to cross your cheque whenever applicable and prevent it from being misused.

- Always draw a line through any unused space.

- Never sign in multiple places unless authenticating a change.

- Avoid using cheques with changes on them. Issue a new cheque if possible.

- When you cancel a cheque, mutilate the MICR band and write “CANCEL” across the face of the cheque

- Do not write/sign/mark/pin/staple/paste/fold on the MICR band.

- Keeping a carbon underneath while writing cheque reduces chance for committing fraud by altering the payee name and/or amount of cheque.

Tips while accepting a Cheque

- Make sure the cheque is signed.

- The cheque must not be post-dated or have any dirty marks on it.

- Handwriting must be consistent on all parts of the cheque.

- Make sure the same pen is used throughout the cheque and the ink is not different.

- Make sure there are no spelling mistakes in the cheque.

- Make sure there is no tampering on the MICR. Be Wise, Get Rich.

Tips to Keep Your Cheque book safe

- Record all details of cheques issued.

- Keep Cheque book at a secure place. Do not leave your Cheque book unattended.

- Whenever you receive your Cheque book, please count the number of cheque leaves in it. If there is a discrepancy, bring it to the notice of the Bank immediately.