If you want to take out a loan in the near future, maintaining a decent CIBIL score is one of the most important factors to consider. It assists the bank in determining your financial competence or soundness to repay the money plus interest within the specified time frame.

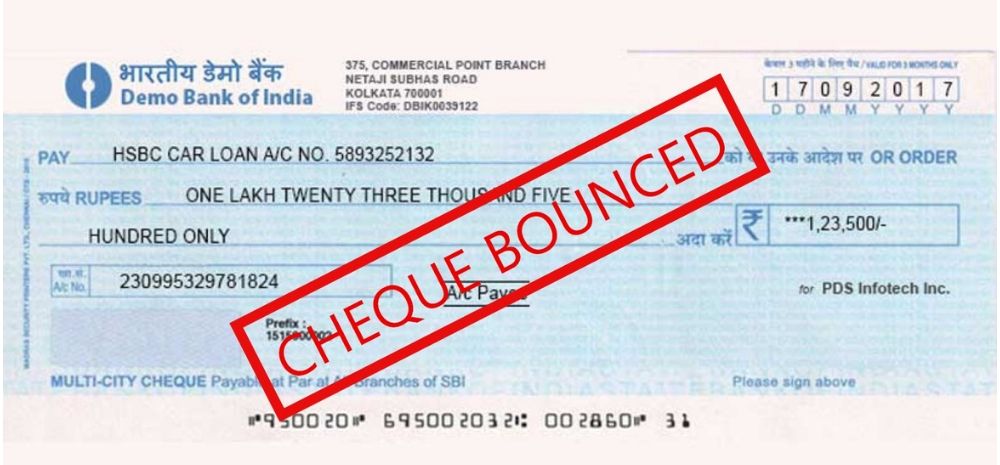

When it comes to your CIBIL score, a bounced check is one of the most significant obstructions that can lower your credit score. While it may have a negative impact on your credit score, this is not the case in every case of a check bounce.

Does Cheque Bounce Have an Impact on Your CIBIL Score?

A cheque bounce occurs when your bank account does not have enough money to process a check withdrawal. In such cases, the bank will return the check to the withdrawer, stating “insufficient funds” as the explanation.

Your CIBIL score may suffer as a result of a bounced check. This will almost certainly cause you issues in the future when asking for a loan or a credit card, as financial organisations are hesitant to lend to someone who has previously been unable to pay their bills.

It’s worth noting that your CIBIL score is solely concerned with on-time payments, and that the fact that your check bounced has only a little influence on your credit score. This basically implies that if you pay your due instalment or bill on time despite a bounced check, your credit score will not be damaged since your capacity to repay will not be harmed. Furthermore, paying on time prevents you from incurring extra fines and fees.

What if your Cheque Bounces?

- Negative Impact on your CIBIL Score

A bounced cheque can dent your financial credit history. Even a single bounce can impact your CIBIL score irreparably to such an extent that you can possibly be denied a loan in the future. The best way to keep your CIBIL score healthy is to make sure your cheques are never dishonored and that there would be at least a few thousand more than the minimum balance for your account even after the cheque is encashed.

- Penalty by the Bank

If your cheque happens to bounce due to insufficient funds or any other technical reason like signature mismatch, both the defaulter and the payee are charged by their respective banks. If the bounced cheque is against the repayment of any loan, you would have to additionally bear the late payment charges (which vary from Rs 200 to Rs 700) along with the penalty fee charges by the bank.

- Civil and Criminal Charges

If you are lucky, you can get away with only a small fine paid to the bank for a bounced cheque. On the other hand, if your stars are aligned against you, the aggrieved party that does not receive the promised funds can file a civil or criminal case against you as an issuer of the cheque.

Where to get Loan with Low CIBIL?

Omozing helps make Smart Money Moves for a Lifetime. They strive to get lowest interest rates and best terms for your Online Applications at www.Omozing.com . We’ve made business lending smarter, faster and easier by transforming the approval process from stumbling blocks to stepping-stones. This enables borrowers to not just get access to capital, but also understand what areas they need to work on in order to enhance their credit profile. Omozing ensures that Borrowers get a secure, safe and reliable application process that be tracked online.

5 Reasons to choose Omozing

1. Loans from INR 10k to INR 10 lakhs

Personal Loan Interest Rates starting from 0.8% p.m, and Loan amount ranging from INR 10,000 to INR 10,00,000. The Minimum and maximum repayment period ranges from 1 month to 48 months. CIBIL 600+ all company categories (including LLP, Self Employed, Proprietorship)

2. Cutomised Tailor Options

- Depending on your demands, we may provide quick financing of varying quantities at affordable interest rates.

- You have the freedom to utilise your loan anyway you want, whether for business or for immediate personal needs.

- Flexible repayment options depending on your specific cash flow and budget, as well as conditions that is beneficial to your position.

3. Lower CIBIL

While most lenders require borrowers to have a CIBIL score of over 750, at Omozing.com provide loans even with 600. Besides the CIBIL score, we also considers your age, employment status, and net monthly income.

4. Ways to apply

You can apply for a personal loan through us by 2 ways:

1. You can download our Mobile Application from Google app store.

2. Apply on portal using out Personal Loan link

5. Prompt Loan Disbursal

An easy online application process facilitates speedy verification and disbursal of loan. Get KYC verified from the comfort of your home and have our loan manager take care of an instant transfer of funds to your account.