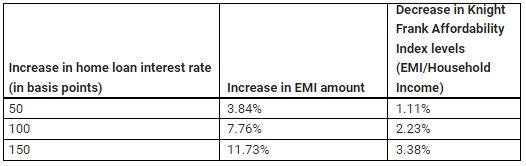

Homebuyers’ affordability is affected by rising mortgage interest rates. Rising interest rates have an influence on house buyer affordability, according to a recent report from Knight Frank India. The note details the impact of a 50, 100, or 150 basis point rise in house loan interest rates, as well as the corresponding increase in EMI and fall in affordability index levels.

The Monetary Policy Committee (MPC) announced a 50-basis-point rise in the repo rate in June, following a 40-basis-point hike in May. Furthermore, the large one-percentage-point increase in the FY23 consumer inflation projection to 6.7 percent, which is higher than the RBI’s upper tolerance range of 6 percent, indicates that more rate hikes are inevitable.

The RBI is expected to keep raising the policy rate to close the gap between consumer inflation and the repo rate, as well as to lessen the extent of the economy’s negative real interest rate, which is still at -1.8 %. While house loan interest rates are still substantially below pre-pandemic levels, it is important to consider the impact of each increase in the rate on the EMI burden and eventual affordability levels of end customers.

Cumulative REPO Rate Hike of 90 Basis Points

The REPO rate was raised by 50 basis points in June by the Monetary Policy Committee (MPC), following a 40-basis-point rise in May. Furthermore, the 1 percentage point increase in the FY23 consumer inflation projection to 6.7 percent, which is higher than the RBI’s upper tolerance range of 6 %, signals that more rate hikes are inevitable. The RBI is expected to keep raising the policy rate to close the gap between consumer inflation and the repo rate, as well as to lower the economy’s negative real interest rate, which is currently at -1.8 %. While home loan interest rates are still significantly below pre-pandemic levels, it is important to consider the impact of each increase in the rate on the EMI burden and eventual affordability of end customers.

Impact of Home Loan increase on EMI and Affordability

Bengaluru Average

Even while lender reaction measures would differ depending on the house loan terms of individual homebuyers, the hike in the Repo Rate in May and now in June will make EMIs more expensive for purchasers. The borrower’s EMIs have increased due to the increase in house loan interest rates in May and now in June. For example, assuming 100% transmission of the repo rate increase, the EMI for a property buyer in Bengaluru with a home loan of INR 75 lacs has risen from INR 59,962 per month before the rate hike to INR 61,803 in May, and now INR 64,141 in June.

NCR Average

Even while lender reaction measures would differ depending on the house loan terms of individual homebuyers, the hike in the Repo Rate in May and now in June will make EMIs more expensive for purchasers. The borrower’s EMIs have increased due to the increase in house loan interest rates in May and now in June. For a property buyer in NCR with a home loan of INR 1 crore, the EMI has climbed from INR 79,949 per month before the rate hike to INR 82,404 in May and now INR 85,521 in June, assuming complete transmission of the repo rate increase.

Mumbai’s Average

Even while lender reaction measures would differ depending on the house loan conditions of individual homebuyers, the hike in the repo rate in May and now in June will make EMIs more expensive for purchasers. For a property buyer in Mumbai with a Rs 2 crore home loan, the EMI has climbed from Rs 159,898 per month before the rate hike to Rs 164,807 in May and now Rs 171,041 in June, assuming complete transmission of the repo rate increase.

5 ways to manage your Home Loan EMIs

The Reserve Bank of India (RBI) surprised everyone by raising the repo rate by 40 basis points in May and 50 basis points in June, ending a period of record low lending interest rates. This walk might not be the last, since we may have to watch many more hikes in the future. Rising interest rates will have the greatest impact on house loan borrowers, as they are the loans with the longest terms and are likely the largest debt a person will ever take out. Because the majority of house loans are taken out at a variable rate, borrowers cannot avoid rising interest rates.

1. Best time for new borrowers to get a Hybrid Loan

If you are a new borrower, then you need to take your time and evaluate a hybrid loan where the lender gives you the loan with a fixed rate for the initial few years after which it starts charging the prevailing floating rate of interest. “Move to semi-fixed rates of 3 years fixed and thereafter floating to ensure the interest rate movement does not affect your loan tenor or EMI

2. Go for Home Saver Option

There are also home loans which give you the option to have an overdraft kind of facility. “Home loan borrowers, both new and existing ones, having liquidity restraints can opt for the home saver option. Under this facility, an overdraft account is opened in the form of a current or savings account where the borrower can park his surpluses and withdraw from it as per his financial requirements

3. Improve your Credit Score to get a better Rate

If you’ve been punctual in repaying your debts, now is the moment to reap the benefits of your efforts.

Existing house loan borrowers who have seen significant changes in their credit profile after taking out their loan, such as a higher credit score, higher income, or a better profession profile, should look into the prospect of saving money on interest by transferring their home loan amount. Other lenders may be able to offer them house loans at considerably reduced rates because of their better credit history.

4. Check to see whether you’re still on the previous Interest Rate Schedule

If you took out a home loan before October 2019, your interest rate will most likely be MCLR, Base Rate, or BPLR. While all new loans were moved to the external benchmark rate after October 2019, existing loans were allowed to continue to be serviced under the old system until borrowers applied for a switch to the new system.

5. Bargain a lower rate with improved Credit Score

If you have been disciplined in repayment, then it may be the time to reap the reward for the same. Existing home loan borrowers who have witnessed substantial improvements in their credit profile due to improved credit score, income or occupation profile since availing their home loan should also explore the possibility of interest cost savings through home loan balance transfer. Their improved credit profile may make them eligible for home loans at much lower rates from other lenders.

Where to get a Short Term Loan?

Omozing helps make Smart Money Moves for a Lifetime. They strive to get lowest interest rates and best terms for your Online Applications at www.Omozing.com .

Why Choose Loans from Omozing?

Omozing helps make Smart Money Moves for a Lifetime. We’ve made business lending smarter, faster and easier by transforming the approval process from stumbling blocks to stepping-stones. This enables borrowers to not just get access to capital, but also understand what areas they need to work on in order to enhance their credit profile. Omozing ensures that Borrowers get a secure, safe and reliable application process that be tracked online.

5 Reasons to choose Omozing

1. Loans from INR 10k to INR 10 lakhs

Personal Loan Interest Rates starting from 0.8% p.m, and Loan amount ranging from INR 10,000 to INR 10,00,000. The Minimum and maximum repayment period ranges from 1 month to 48 months. CIBIL 600+ all company categories (including LLP, Self Employed, Proprietorship)

2. Cutomised Tailor Options

- Depending on your demands, we may provide quick financing of varying quantities at affordable interest rates.

- You have the freedom to utilise your loan anyway you want, whether for business or for immediate personal needs.

- Flexible repayment options depending on your specific cash flow and budget, as well as conditions that is beneficial to your position.

3. Lower CIBIL

While most lenders require borrowers to have a CIBIL score of over 750, at Omozing.com provide loans even with 600. Besides the CIBIL score, we also considers your age, employment status, and net monthly income.

4. Ways to apply

You can apply for a personal loan through us by 2 ways:

1. You can download our Mobile Application from Google app store.

2. Apply on portal using out Personal Loan link

5. Prompt Loan Disbursal

An easy online application process facilitates speedy verification and disbursal of loan. Get KYC verified from the comfort of your home and have our loan manager take care of an instant transfer of funds to your account.

These are the Documents Required for the loans process and Types of Personal Loan

5 Things you can do to save you’re Hard Earned Money

- Currently, as the Fixed Deposit (FD) rates are low and in the range of 3.1 per cent to 4.1 per cent, the home loan customers can pre-pay a part of their loans out of their FDs.

- Also, as the rates are expected to remain lower in near future, the customers can also raise their EMIs for the next 12-18 months to lower the impact of rate hikes.

- As the return on FDs is relatively low as compared to current inflation levels, people can go for more short term investment options (PPF etc.) rather than long term ones.

- The share market is giving good returns to investors. With proper guidance and research, markets can become an attractive place for investment. The return has to be more than 7 per cent, to beat the inflation. According to experts, a fall in the share market must be seen as an opportunity to buy more shares.

- Investors must also diversify their portfolios by including more equity instruments and mutual funds as it would lead to better tax management.

The interest rate hikes by banks, especially after the RBI raised the base rates, was a foregone conclusion. However, I wish that the banks had waited for a few more months for this series of hikes. At least it could have waited for the real estate sector to pass on the benefits of the reduction in fuel prices and the decrease in the price of iron (through hike in export duty) to the customers. The move will also affect the development of the commercial and retail segments.

A few developers said the current round of hikes could make the buyers apprehensive and they might as well adopt a wait and watch attitude for some more time.

The current hike in home loan interest rates by banks will surely convey to home buyers that interest rates are only going to go northwards. Contrary to the popular perception that any such increase only affects the affordable housing segment, the move, according to me, will also leave a big impact in the big-ticket luxury segment that involves high volumes of money, hence higher EMIs and higher interest amount. Besides, since one of the banks has increased its RPLR three times in one month, the move will also add to the uncertainty regarding the quantum of hikes in the future.

In practical terms, the increase in home loan rates usually translates to an increase in tenure rather than an actual increase in EMI, effectively subduing its impact to some extent. While steep, the interest rate hikes are not a surprise and have been factored into the market sentiment which continues to hold strong. We do not believe that home loan rates approaching 2019 levels will be enough to subdue market momentum significantly. The performance of the broader economy will have a greater bearing on market momentum for the remainder of the year as it dictates homebuyer income levels and demand much more directly. As things stand currently, the RBI having kept the FY23 GDP growth estimate constant gives credence to our belief that residential demand should not be impacted materially in 2022