1. Use a Portfolio Tracker

Do you know how your funds did in 2019? Or how much returns have you earned in the past three years? Are all the funds in your portfolio performing well, or do you need to get rid of some? Not many investors will be able to answer because they wouldn’t have ever taken a holistic view of their portfolio, leave alone analysing it.

Investors will particularly like the tax section, where the investor gets to know the capital gains he has earned in each financial year. That’s not all. The capital gains from debt and hybrid funds are indexed to inflation so you don’t have to do any complex calculation when filing your tax returns.

Many individuals may have lost track of the investments done in the past and won’t even know if they still exist. For such investors, the portfolio tracker is a godsend. All one needs to do is upload the mutual fund statement from CAMS or other agencies and the tracker automatically registers the entire portfolio since inception. All funds linked to the PAN number get included in the portfolio, so even if you forget an investment, it shows up in the portfolio.

Similarly, investors can upload their NPS statements and include fixed income (PPF, bank deposits, bonds) in the portfolio.

2. Avoid FDs, go for RBI bonds

The RBI cut rates aggressively in 2019. While borrowers were happy, investors in fixed income instruments saw their returns come down. SBI reduced its 5-10 year deposit rates to 6.75% for senior citizens and 6.25% for others. Though co-operative banks and some small private banks are offering higher rates, investors should avoid investing in them. The PMC Bank crisis shows how the entire principle can get stuck just to earn an extra 1-1.5%.

These investments are better than bank FDs. But they are more lucrative for investors in the lower tax brackets.

Senior Citizens’ Saving Scheme and PM Vaya vandana Yojana are only for senior citizens and maximum investment limit is Rs 15 lakh each

However, interest rates on government sponsored schemes like the Senior Citizens’ Savings Scheme (SCSS), PM Vaya Vandana Yojana (PMVVY), National Savings Certificate (NSC) and RBI bonds are still quite high nin comparison. These rates have not changed since July 2019 and are unlikely to be changed now. While SCSS and PMVVY are only for senior citizens and the maximum investment is `15 lakh each, there are no such limits for NSCs and RBI bonds.

3. Review Debt Fund Portfolio

The year 2019 was painful for many debt fund investors. Rating downgrades or defaults took a chunk out of the value of debt schemes with exposure to lower quality instruments. Fund houses have been caught on the wrong foot too often. They are now getting wiser and growing more conscious of risks, but investors need to watch out for themselves. In 2020, monitor the portfolio of your debt fund more closely. Avoid debt funds that take high exposure to instruments issued by a single entity. This increases the risk profile of the fund. Also watch out for sharp drop in the corpus of a scheme within a short time. When a scheme faces large redemptions, exposure to existing instruments of lower quality gets amplified, resulting in higher concentration of low quality in the portfolio.

4. Hike exposure to the Mid-Cap Segment

If you look at frontline indices such as the Sensex and the Nifty, you get the feeling that the stock markets are doing exceptionally well. The 15% rise in the Sensex in the past one year, despite the economic woes, is truly remarkable. However, these indices have been pushed up by just 5-6 stocks while the broader market is still in the doldrums. The BSE Midcap and Smallcap indices have lost 4.13% and 8.65% respectively during the past one year. Since this kind of narrow rally can’t be sustained for long, experts are advising investors to shift a part of their portfolio from large caps to the next level.

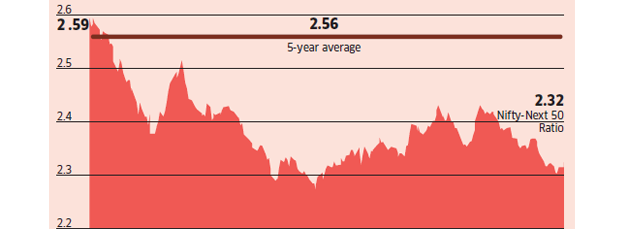

Mid-caps have commanded a higher premium than large-cap stocks in the past five years. During this period, the Nifty-Next 50 ratio averaged 2.56. In other words, the next 50 level was on average 2.56 times the Nifty level in the past five years. But during 2019, mid-cap anastocks faced rough weather and this ratio slipped to 2.27 in June. It now stands at 2.32. The valuation premium of the mid cap segment has also come down. The BSE 150 Midcap Index PE is now placed at 29.26, only slightly higher than the Sensex PE of 28.36. Experts believe mid-caps will bounce back and are therefore advising a higher allocation to these segments.

Midcap stocks took a beating in 2019. The Nifty-Next 50 ratio came down sharply during the year.

5. Pare expectations of Returns

Returns from equity investments have sobered over the past few years and are likely to remain modest in the coming years as well. This is true whether you are investing through SIPs or lump sum. The SIP is not some magic pill that can deliver under any market condition. It is simply a tool that allows investors to put savings on autopilot and invest in the equity market in a disciplined manner. It doesn’t let market volatility deter from savings habit. This lets you ride out the market upheavals and can fetch healthy returns over time.

However, if you have started a long term SIP a few years back expecting to earn 15-18% annualised return; you are likely to be disappointed. When the market return itself has moderated to low double digits, equity funds cannot be expected to deliver much higher. With returns expected to remain soft, investors also need to recalibrate their savings for long term financial goals.