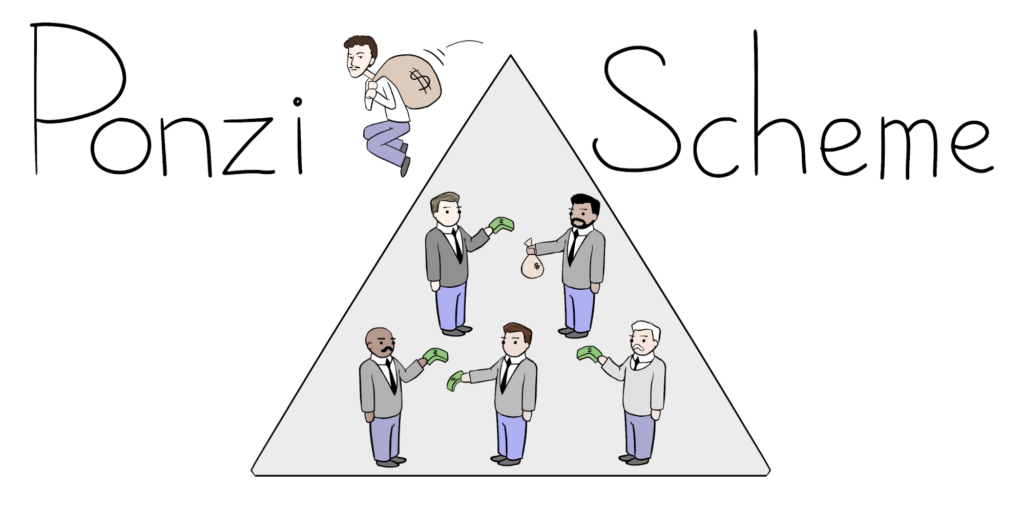

What is Ponzi Scheme?

A Ponzi Scheme is a fraudulent investment operation where the operator, an individual or an organisation, pays returns to its investors from new capital paid to the operators by new investors, rather than from profit earned through legitimate sources. Typically, extraordinary returns are promised on the original investment. The fraudster will vanish with investors’ money, so the system eventually collapses with later investors receiving nothing – including their initial investment.

However, in the real sense, the fraudsters don’t really plan to invest the money. Their intention is to pay off the earliest investors to make the scheme look believable. As such, a Ponzi scheme requires a constant flow of funds to sustain itself. When the organizers can no longer recruit more members or when a vast proportion of the existing investors decide to cash out, the scheme tumbles.

Warning signs of a Ponzi Scheme

- The rate of return is sometimes suspiciously high (maybe as high as 10% per month or 120% per year) – but it can also be just the usual rate of return

- The person who tries to recruit you is someone you think is trustworthy, like a neighbour or someone in your church or community group

- The recruiter may have already invested in the scheme and received great dividends

Characteristics of a Ponzi Scheme

Ponzi scheme entails the following characteristics:

- Ponzi scheme is a fraudulent investment scheme as it uses the investments of new investors to repay the profits to the earlier investors.

- It guarantees regular returns, irrespective of the conditions prevailing in the economy.

- It attracts new investors by promising to reward them with a high rate of return, usually higher than the market return value.

- The Ponzi schemes are illegitimate and unregistered investment schemes.

- The Ponzi scheme works only because of the investor’s greed to earn more and more profit on their investment.

- It depends on the continuing flow of new investor’s investment; whenever there is any delay or time gap in finding new investors this scheme crumbles.

How to Protect yourself from Ponzi Schemes

In the same way that an investor researches a company whose stock he’s about to purchase, an individual should investigate anyone who helps him manage his finances. The easiest way to go about it is to contact the SEBI and ask if their accountants are currently conducting open investigations (or investigated prior cases of fraud). Also, before investing in any scheme, one should ask for the company’s financial records to verify whether they are legit.

Ponzi Schemes risks involved

Most Ponzi schemes come with some common attributes such as:

1. Promise of High Returns with Minimal Risk

In the real world, every investment one makes carries with it some degree of risk. In fact, investments that offer high returns typically carry more risk. So, if someone offers an investment with high returns and few risks, it is likely to be a too-good-to-be-true deal. Chances are the investor won’t see any returns.

2. Overly Consistent Returns

Investments experience fluctuations all the time. For example, if one invests in the shares of a given company, there are times when the share price will increase, and other times it will decrease. That said, investors should always be skeptical of investments that generate high returns consistently regardless of the fluctuating market conditions.

3. Unregistered Investments

Before rushing to invest in a scheme, it’s important to confirm whether the investment company is registered with SEBI or state regulators. If it’s registered, then an investor can access information regarding the company to determine whether it’s legitimate.

4. Unlicensed Sellers

According to central and state law, one should possess a specific license or be registered with a regulating body. Most Ponzi schemes deal with unlicensed individuals and companies.

5. Secretive, Sophisticated Strategies

One should avoid investments that consist of procedures that are too complex to understand.

6. Working Methodology

The working methodology of Ponzi schemes are usually kept secret and they don’t provide complete information about how they give such a high rate of return.

7. Delay in Payment

The investors usually experience delays in receiving payment as the payment is dependent on the new investors.The earlier investors are also suggested to invest their money again in order to get high rate of returns on that.

Advantages of Ponzi Scheme

- High Rate of Returns: The earlier investors get a high rate of returns with the help of Ponzi schemes. They find it more profitable as compared to investing in other schemes.

- Low or no Risk: The earlier investors enjoy low or risk-free investment which is quite impossible in other schemes of investment.

- No need for Huge Capital: There is no need for having huge capital for Ponzi scheme as this scheme is dependent on new investor’s investment.

Disadvantages of Ponzi Scheme

- Delay in payment: There is a delay in payment in the Ponzi scheme.The earlier investors don’t get their return on time and they are also pressurized to reinvest to get a high rate of return.

- Loss of earlier investors: If the Ponzi scheme is unable to attract new investors then it will be a loss to the earlier investors as the Ponzi scheme totally depends on new investors.

- Dependency on new investors: The Ponzi scheme is dependent on new investors as their investments are used to repay to the earlier investors so when the Ponzi scheme is unable to attract new investors, the scheme collapses.

- Difficulty in filing complaint: Ponzi scheme are usually unregistered and if the company runs away after doing fraud then it is difficult to file a complaint.

Reasons you may fall Prey to Ponzi Schemes

One of the main reasons is greed. You want to make quick money in no time and throw caution to the winds. You also do not care to find out where you invest. A simple question you need to ask yourself. Who eats emu meat and emu eggs. Well if no one does, then where do they get the money and how would they repay you?

Lack of Financial Literacy

Crores of people in our country do not know what a bank account is. Many who do, have no access to one. Financial literacy is the need of the hour. Citizens of our country who reside in rural areas need to learn the following. What is a bank? What is a bank deposit? What is life insurance? What is saving? What is investing?

The next question is the big one. What are the realistic returns you can expect from your savings and investments? Savings bank accounts give returns of 4% a year. Fixed deposits give returns of 7% a year. But Ponzi schemes promise unlimited returns. A Ponzi scheme promises 100% to 300% a year or even more. How can a Ponzi scheme give such high returns? Alarm bells should ring in your head when you are promised such high returns.

Conclusion

Ponzi scheme, being a fraudulent scheme of investment is highly uncertain and unsecured. If an investor is ready to bear such risk and is concerned only with the high rate of return inspite of all the disadvantages it bears then only he or she must invest. Investors should gather proper market knowledge of Ponzi investment before start investing but if they are unable to do so, they can invest in other schemes.