Secured Business Loans are loans taken by the borrower to start or enhance a business with collateral. The borrower needs to pledge any of his property or asset. The debt is hence secured against the collateral provided. In the event of the borrower failing to re-pay the loan, the lender takes possession of the collateral.

Requirements for a secured business loan

- Keep records of your property/asset’s worth.

- Understand the risks of losing an asset. Always consult a financial advisor.

- If you have a good business credit and sure of securing a business loan – Negotiate

- Get a quote on the loan by filling in and submitting the details from the free quote

- Age – Most banks disburse business loans to individuals aged between 24 to 65 years.

- Current Business Experience Banks will prefer that your business has been showing stable signs of growth at least for the last 3 years. Some banks give a loan amount up to 60 to 80% of your median annual profits.

- Total Business Experience A bank will prefer if you have been engaged in sustainable business for at least 5 years to consider giving you a loan.

Features of secured loans

- Loans are given against the title of ownership of assets, which will be used as collateral (like homes, vehicles, assets, property).

- Lower interest rates as compared to unsecured loans, because the bank has a higher level of confidence in your ability to repay.

- More flexible repayment options than regular loans.

- The option of the fixed-rate and variable rate.

- Loan approval is faster.

- Customisation loans to cater to specific needs.

- These loans are available to non-salaried individuals.

- There is no need for a guarantor for these types of loans.

- Banks and lenders can repossess assets for which loans were taken.

- Improves CIBIL score once secured loan has been repaid in full. More favourable than unsecured loans.

Eligibility criteria

- You must meet the following requirements to be eligible for a secured loan:

- Applicants must have reached the age of 18 years or older.

- Applicant must be a resident of India.

- Most banks and lenders require the applicant to have a minimum annual income of Rs.3 lakh per annum.

- Income can be generated from the regular salary, non-salaried income, and business income.

- For loans based on business income, the business must have been running and generating a profit for the last 3 years.

- Applicant must have assets, whose value must match or exceed the value of loan required.

Secured Business Loan-What You Need to Know?

Secured business loans aren’t only secured by physical collateral these days. So if you don’t have a real estate holding, vehicle, or equipment of sufficient value to secure your business loan, you’re not out of secured financing options.

Lenders can also give secured business loans by asking borrowers to give a personal guarantee.

What’s a Personal Guarantee?

A personal guarantee is an agreement with your lender that puts your personal assets on the line making you the loan’s co-signer.

When it comes to personal guarantees, the idea isn’t all that different than putting up collateral. It gives lenders a way to minimize their risk when they lend to your business.

If you’ve given your lender a personal guarantee and you default on your loan, you’re personally responsible for repaying the loan.

This means that creditors can claim your personal assets as repayment—whether that’s your home, investment accounts, and so on.

The Difference Between Collateral and Personal Guarantees

The idea behind collateral and personal guarantees is essentially the same: lenders are protecting themselves from the chance that they lose all their money.

But here’s why they mean different things when you use them for secured business loans:

Putting up collateral on a loan requires you to stake one or a few particular assets—like a house or a car. A personal guarantee gives creditors the right to seize any and all financial assets that you have now (or even those you’ll obtain down the road).

- Unlimited Personal Guarantee

When you secure a business loan with a personal guarantee, you can give lenders an unlimited personal guarantee.

This means that lenders can recover 100% of the loan amount, plus any legal fees associated with the loan.

Let’s look at this in the worst case: your business fails and you default on your loan. Your lender can hire lawyers to gain a judgment in their favor, giving them the legal ability to go after any or all of your personal assets you have.

This could be your life savings, your retirement savings, your house, your kid’s education fund even your spouse’s personal assets are fair game.

Until they reclaim the total cost of the loan, plus interest and legal fees, lenders can seize any personal asset they want.

Sounds pretty unlimited, right? When signing an unlimited personal guarantee, borrowers have basically no financial protection if they couldn’t keep up with their loan payments.

- Limited Personal Guarantees

As you can probably guess, a limited personal guarantee sets specific parameters on what can be seized from you if you default on your loan. A limited personal guarantee will usually be limited by a dollar amount.

A limited personal guarantee is most often when multiple business partners take out a loan for the company together. So if you have a certain percentage of ownership in your business, you should be prepared to be a part of the guaranteeing process for your company’s business loan.

If you secure an SBA loan, for instance, the SBA requires that anyone with a 20% or greater stake in the business is a part of the guaranteeing process.

When you sign a limited personal guarantee in this scenario, you’re dividing up some of the debt burden in the case that your business defaults on its loan.

When compared to an unlimited personal guarantee, it might seem like a limited personal guarantee means less risk for you. But it depends on what you’re signing.

You’ll want to check if you’re signing a several guarantees or a joint and several guarantees.

How to get a Secured Business Loan?

First, ask yourself these questions:

- Consider what assets you feel comfortable leveraging.

- Would you rather leverage someone else’s assets as collateral?

- What kind of repayment terms are you after?

- What are you going to use your funds for?

- How much do you need?

It might sound like a simple/obvious question, but in reality it can be one of the most difficult to answer. A secured small business loan that offers too-little can leave you unable to fund your business goals. Too much can leave you repaying excess money that you don’t need for a long, long time. Take the time to think about this.

Documents required

- Certified Financial Statement for the last 2 years.

- Your Proof of Residence – Passport / / Voters ID card / Driving License / Adhaar Card

- Your Proof of Identity – Passport / Pan card / Voters ID card / Driving License / Adhaar Card

- Your Proof of Business : Shops & Establishment certificate / Trade license certificate / SSI registration certificate / Sales certificate / Partnership deed for firms / Memorandum of Association for companies

- Your latest Bank Statement from where you operate your business from the past 6 months.

- Copies of all Property Documents of the concerned property that you chose to pledge for the loan.

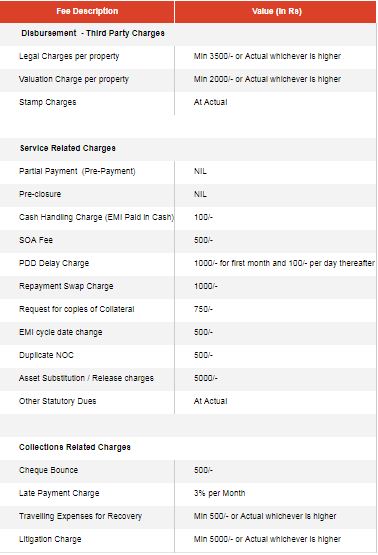

Schedule of Charges

What type of business might use a Secured Business Loan?

The difficulty that owners have is making the right choice between a secured or unsecured loan.

A secured business loan is an excellent solution for those with a poor credit rating. It is a great option if you want to start a new business or expand your business. If your secured business loan is approved, you will have a lower APR rate and very likely a longer repayment period. This can make it affordable for start-up businesses to get the cash they need during a time when profits are just starting to grow.

Unsecured loans appear more attractive, but although they are often approved quickly, there is a bigger cost involved. Unsecured mean that there is no collateral offered, thus making it a risky business for the lender. Therefore, banks are obliged to charge higher interest rates, and some of them get the most out of it by charging exorbitant interest to reduce the risk on their capital.

How Does Secured Business Finance Work?

Whether you’re expanding your workforce, purchasing new equipment, tools, or machinery, or simply need additional working capital to tide your business over, a secured business loan could well be the answer.

It all starts by completing your Capitalise profile which takes just 3 minutes. Simply enter some basic information about your business and the required loan, and we’ll match your company with lenders who can not only provide the capital needed but offer an excellent chance of accepting you.

You’ll be able to upload key information, for example regarding your assets, through the Capitalise platform, greatly reducing the time it takes to assess each application. An affordable repayment plan will be created based on your circumstances, with all payments clearly listed to avoid any nasty surprises.

Once you’ve been approved, funds will typically be issued within just a few working days, leaving you to concentrate on growing your business.