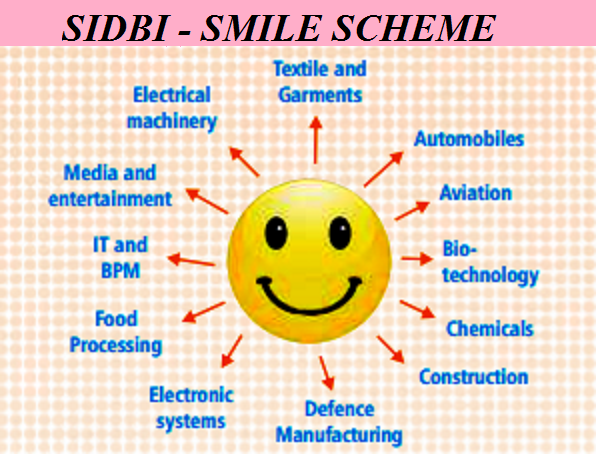

SIDBI Make in India Loan for Enterprises (SMILE) is intended to take forward Government of India’s ‘Make in India’ campaign and help MSMEs take part in the campaign.

The focus will be on identified 25 sectors under ‘Make in India’ programme’ with emphasis on financing smaller enterprises within the MSME sector. The scheme is expected to benefit approximately 13,000 enterprises, with employment for nearly 2 lakh persons.

Objective of the Scheme

The objective of the Scheme is to provide soft loan, in the nature of quasi-equity and term loan on relatively soft terms to MSMEs to meet the required debt-equity ratio for establishment of an MSME as also for pursuing opportunities for growth for existing MSMEs.

| SMILE (SIDBI) 2020 | |

| Nature | Quasi – Equity (Soft Loan) |

| Interest Rate | As per enterprise’s profile and requirements |

| Min. Loan Amount | Rs. 10 lakh for equipment finance |

| Max. Loan Amount | Rs. 25 lakh |

| Repayment period | Max. 10 years, including moratorium of up to 36 months |

| Minimum Promoter Contribution | 15% subject to Maximum Debt Equity Ratio (DER) of 3:1 |

| Security | First charge over all assetsPersonal guarantee of promoters |

Key Points

- Competitive interest rates.

- Funding of part Promoter contribution by way of soft loans.

- Longer repayment period.

- Quick dispensation

Eligibility Criteria

- Emphasis will be on covering new enterprises in the manufacturing as well as services sector.

- The emphasis will however, be on financing smaller enterprises within MSME.

- Existing enterprises undertaking expansion, to take advantage of new emerging opportunities, as also undertaking modernization, technology up gradation or other projects for growing their business will also be covered.

- Minimum Loan Size – ₹ 10 lakh for Equipment Finance & Others: ₹ 25 lakh.

Tenure and Moratorium

- Longer repayment period upto 10 years including moratorium of upto 36 months.

- Minimum Promoter Contribution of 15% subject to Maximum DER of 3:1

Security:

Term Loan

- First charge over all assets created under the project.

- Personal guarantee of promoter(s).

- Cases involving term loan up to ₹ 2 crore may be covered under Credit Guarantee Scheme of CGTMSE.

ACR and FACR norms would be applicable in terms of extant Loan Policy.

Soft Loan

- Residual charge over the entire assets

- Personal Guarantee of the Promoter(s).