Investing in Property: Why City Real Estate is Your Best chance

Investing in property has long been a tried-and-true method for building wealth and ensuring financial stability. While rural and suburban properties have their appeal, city

Investing in property has long been a tried-and-true method for building wealth and ensuring financial stability. While rural and suburban properties have their appeal, city

Financial planning is crucial for everyone, but for millennials in India, it holds particular importance due to the unique economic landscape and challenges they face.

A top-up loan in India is an additional loan that can be taken on an existing loan, whether it’s a home loan, personal loan, or

Debt traps can be overwhelming and stressful, affecting not just your financial health but your mental well-being too. For many in India, managing finances can

Securing a loan can be an overwhelming process, especially when dealing with complex loan applications that involve substantial amounts or stringent eligibility criteria. In such

Dreaming of a perfect getaway but worried about the expenses? You are not alone. Many people find themselves longing for a vacation but hesitating due

In today’s fast-paced world, credit cards have become indispensable for many Indians. They offer convenience, rewards, and the ability to manage cash flow effectively. However,

In today’s fast-paced world, personal loans have become an essential financial tool for many Indians. Whether it is for funding a wedding, handling medical emergencies,

What is Dishonor/Cheque Bounce? A Dishonored Cheque is cheque that the bank on which is drawn declines to pay (“honour”). There are a number of

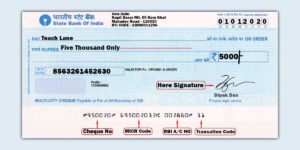

Cheque Truncation System or CTS is the cheque clearance system introduced by RBI to fasten up the clearing of cheques. In this system, instead of

Cheques are the backbone of the banking industry and are still a very important negotiable instrument in the country. Reserve Bank of India (RBI) report

One of the most common ways to pay money is through a cheque. Writing a cheque is really easy, but you must be careful. A