Balancing Career and Finances: Tips for Working Women in India

Balancing career and finances are a multi-faceted challenge that many working women in India face. The evolving social landscape, the push for financial independence, and

Balancing career and finances are a multi-faceted challenge that many working women in India face. The evolving social landscape, the push for financial independence, and

In an era where instant solutions are often sought for financial needs, payday loans have emerged as a popular yet controversial option. With promises of

Investing in property has long been a tried-and-true method for building wealth and ensuring financial stability. While rural and suburban properties have their appeal, city

Financial planning is crucial for everyone, but for millennials in India, it holds particular importance due to the unique economic landscape and challenges they face.

A top-up loan in India is an additional loan that can be taken on an existing loan, whether it’s a home loan, personal loan, or

Debt traps can be overwhelming and stressful, affecting not just your financial health but your mental well-being too. For many in India, managing finances can

Securing a loan can be an overwhelming process, especially when dealing with complex loan applications that involve substantial amounts or stringent eligibility criteria. In such

Dreaming of a perfect getaway but worried about the expenses? You are not alone. Many people find themselves longing for a vacation but hesitating due

In today’s fast-paced world, credit cards have become indispensable for many Indians. They offer convenience, rewards, and the ability to manage cash flow effectively. However,

The following are the Blog Reasons why Employers need to engage with a Financial Wellness Partner like Omozing in India: By engaging with a financial

The following are the top 7 compelling reasons why Omozing.com credit counselling for low cibil scores in India can help transform the financial health: 1.

The following are the 10 point Remedy for CIBIL less than 600 in India: Please read the Related Blogs below:

The following are the top 10 quick points on what to do when you have a CIBIL write-off: Here is how Omozing.com is a registered

1. Employee Financial Wellness Why Financial Wellness of Employees is a Key Result area for HR now? What is the importance of Employee Financial Wellness?

The following are the 7 factors other than CIBIL score than CIBIL that may impact your loan approval and eligibility in India: 1. Income Financial

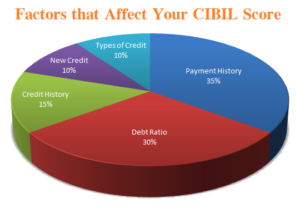

The following are the 9 hacks to improve your CIBIL score fast in India: 1. Pay Bills on Time Late or missed payments can have

The following are the 11 Factors that lead to low CIBIL Score in India: 1. Late or Missed Payments A history of late or missed

Rahul, a 26-year-old working in a MNC Bank in Bangalore, had a CIBIL score of 637 and was facing difficulty in getting a loan due

Your CIBIL report is a comprehensive document that contains information about your credit history, including information about your credit accounts, payment history, and credit inquiries.

The following are the ways to get rid of Payday Loans in India: 1. Negotiate with the Lender Try to negotiate a payment plan or

The following are the 7 Reasons How Payday Loans Can Make Your CIBIL Score Low in an Year’s Time 1. High Interest Rates Payday loans

Payday loans can seem like a quick and easy solution for those in need of cash, but they come with a number of downsides that

The following are the 5 Alternatives to Payday Loans: 1. Short Term Loans through Apps Omozing like mobile app are a great alternative to payday

Payday loans are small, unsecured short-term cash loans that people borrow to get through the month until their next salary kicks in. It is thus,

Typically, it becomes challenging for an individual to satisfy his modest financial demands for vacations, weddings, purchasing used two-wheelers, or any other necessities. It is

Compound interest is the interest on a loan or deposit calculated based on both the initial principal and the accumulated interest from previous periods. This

When applying for a loan in India, lenders typically require proof of address to verify the borrower’s residency. The following are some common types of

Bringing a co-applicant to a loan application can be a beneficial strategy for increasing the chances of loan approval and getting a better interest rate.

Credit card debt can be a significant financial burden for many individuals. High interest rates and revolving balances can make it difficult to pay off