How to Save Tax on Personal Loans in India 2024

Have you ever wondered how to Save Tax on Personal Loans 2024 in India? Whether you hold a managerial position, work as a Software Engineer,

Have you ever wondered how to Save Tax on Personal Loans 2024 in India? Whether you hold a managerial position, work as a Software Engineer,

Valentine’s Day isn’t just about love; it’s also an opportunity for couples to strengthen their bond, including their financial bond. Achieving financial freedom as a

Tip 1: Rent to Parents for HRA Benefits For those residing in rented accommodations, the first tax-saving hack revolves around optimizing House Rent Allowance (HRA)

Women, on the other hand, must balance job and domestic responsibilities. Despite their equal partnership, women are still responsible for child raising, transporting children to

Setting a financial resolution for 2024 is like drawing up a blueprint for a more secure and prosperousfuture. It involves a commitment to intentional and

1. Importance of Education: In the vibrant tapestry of Indian life, education is not just a means to a career but a lifelong pursuit. Much

It’s a common quirk of human nature to feel the need to take action, especially in the realm of investments. However, one of the wisest

Charlie Munger, the brilliant mind behind Berkshire Hathaway alongside Warren Buffett, stands as a luminary in the world of finance, renowned not just for his

Introduction: Greetings, fellow investors! As your friendly financial advisor, I’m here to unravel the secrets of wealth creation through the lens of one of the

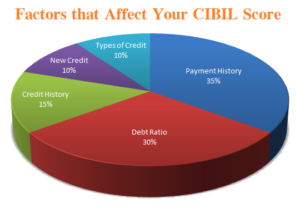

The following are the 11 Factors that lead to low CIBIL Score in India: 1. Late or Missed Payments A history of late or missed

Rahul, a 26-year-old working in a MNC Bank in Bangalore, had a CIBIL score of 637 and was facing difficulty in getting a loan due

Your CIBIL report is a comprehensive document that contains information about your credit history, including information about your credit accounts, payment history, and credit inquiries.

The following are the ways to get rid of Payday Loans in India: 1. Negotiate with the Lender Try to negotiate a payment plan or

The following are the 7 Reasons How Payday Loans Can Make Your CIBIL Score Low in an Year’s Time 1. High Interest Rates Payday loans

Payday loans can seem like a quick and easy solution for those in need of cash, but they come with a number of downsides that

The following are the 5 Alternatives to Payday Loans: 1. Short Term Loans through Apps Omozing like mobile app are a great alternative to payday

Payday loans are small, unsecured short-term cash loans that people borrow to get through the month until their next salary kicks in. It is thus,

Typically, it becomes challenging for an individual to satisfy his modest financial demands for vacations, weddings, purchasing used two-wheelers, or any other necessities. It is

As the major goal of financial planning is to decrease tax liabilities and increase savings, tax planning is one of the crucial components of that

Compound interest is the interest on a loan or deposit calculated based on both the initial principal and the accumulated interest from previous periods. This

When applying for a loan in India, lenders typically require proof of address to verify the borrower’s residency. The following are some common types of

Bringing a co-applicant to a loan application can be a beneficial strategy for increasing the chances of loan approval and getting a better interest rate.

Credit card debt can be a significant financial burden for many individuals. High interest rates and revolving balances can make it difficult to pay off

In order to accomplish many of your goals and get through any emergency situations that may arise for many reasons, credit is crucial. Having a

In the previous two years, housing prices have fallen and loan interest rates have reached historic lows, increasing the affordability of homes. In light of

There are several reasons why an Omozing personal loan may be a better option than using a credit card for certain financial situations. First and

Conducting a financial health check for employees can be an important step in ensuring that they are on a stable financial footing, which can have

A home loan is a loan obtained by a person from a bank or other financial organization at a specific interest rate in order to

A financial health check is a comprehensive evaluation of an individual’s current financial situation and helps identify any areas that may require attention or improvement.