How to Save Tax on Personal Loans in India 2024

Have you ever wondered how to Save Tax on Personal Loans 2024 in India? Whether you hold a managerial position, work as a Software Engineer,

Have you ever wondered how to Save Tax on Personal Loans 2024 in India? Whether you hold a managerial position, work as a Software Engineer,

Valentine’s Day isn’t just about love; it’s also an opportunity for couples to strengthen their bond, including their financial bond. Achieving financial freedom as a

Tip 1: Rent to Parents for HRA Benefits For those residing in rented accommodations, the first tax-saving hack revolves around optimizing House Rent Allowance (HRA)

Women, on the other hand, must balance job and domestic responsibilities. Despite their equal partnership, women are still responsible for child raising, transporting children to

Setting a financial resolution for 2024 is like drawing up a blueprint for a more secure and prosperousfuture. It involves a commitment to intentional and

1. Importance of Education: In the vibrant tapestry of Indian life, education is not just a means to a career but a lifelong pursuit. Much

It’s a common quirk of human nature to feel the need to take action, especially in the realm of investments. However, one of the wisest

Charlie Munger, the brilliant mind behind Berkshire Hathaway alongside Warren Buffett, stands as a luminary in the world of finance, renowned not just for his

Introduction: Greetings, fellow investors! As your friendly financial advisor, I’m here to unravel the secrets of wealth creation through the lens of one of the

You play a vital part in defending your own and financial information. The initial step is realizing how to spot basic monetary trick strategies and

Aadhaar is one of the most powerful instruments in India today. UIDAI has generated 1.21 billion Aadhaar cards till date and has covered more than

ATM fraud means more than covering the keypad as you enter your Personal Identification Number (PIN). Just as technology continues to evolve, financial scammers update

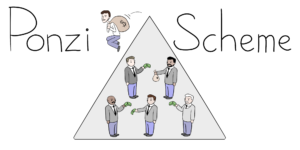

What is Ponzi Scheme? A Ponzi Scheme is a fraudulent investment operation where the operator, an individual or an organisation, pays returns to its investors

Gold hallmarking is a purity certification of the precious metal and is voluntary in nature at present. Buyers of gold jewellery will now have the assurance

Beware of PAN Frauds The increasing importance of PAN has increased the likeliness of PAN Card identity theft. The safeguarding of the physical copy of

Here are some finance tips for 10 year olds. These are a few things to remember in life whenever touching upon money. 1. Know your

If you have never taken a loan you won’t have a credit score or report. This presents a unique problem – some lenders will not

The buying factors that affect our (emotional) purchase decisions are highly personal such as love, sentiment, envy, pride, entertainment, and vanity. We will talk more

Income tax is a type of tax that the central government charges on the income earned during a financial year by the individuals and businesses.Taxes

Savings Schemes are investment options for Indian citizens launched by the government as well as other public sector financial institutions. These saving schemes were introduced

Top 7 Government Schemes to Invest There are various schemes launched by the Government of India that help in strengthening the financial stability of the

Most victim compensation programs do not cover the money lost to fraud or fraudulent schemes. You must check for your specific state laws regarding victim compensation. Civil

Online Frauds are different methodologies of Fraud, facilitated by cybercriminals on the Internet. Scams can happen in a myriad of ways- via phishing emails, social

Why my Business Loan got rejected? It is common for business loans to get rejected. Getting your application rejected doesn’t mean it’s the end of

Personal loans are well known for being flexible. The flexibility in terms of loan amount and repayment makes it one of the most used credit

Is taking a loan to get rid of credit card bills a good decision? Yes, taking a Personal Loan to pay off your Credit Card

A home is usually said to be a reflection of its owner. You can now spruce up your home and make renovation a milestone as

Unexpected events in life sometimes make us end up in hospitals with a pile medical bill. Medical emergencies crop up any time and require a

A Personal Loan for the purpose of financing a vacation or travel in India or abroad is known as a Travel Loan or a Vacation