Business Loan Even with Bad Credit

Business Loan with Bad Credit | CIBIL 600+ Get a Business Loan Even with Bad Credit Empowering entrepreneurs with CIBIL scores starting at 600+. Access

Business Loan with Bad Credit | CIBIL 600+ Get a Business Loan Even with Bad Credit Empowering entrepreneurs with CIBIL scores starting at 600+. Access

Boost Credit Score & Business Loans for Bad Credit | Omozing & Aparampaar Finance Banks Saying NO to Loans? Omozing’s Credit Booster Program Unlocks Your

ULTIMATE GUIDE: Advance Salary Loan in India ULTIMATE GUIDE: Advance Salary Loan in India How to Get Instant Salary Advance Loan Online — And How

How to Get an Urgent Loan with Bad CIBIL Score in India (2025) ULTIMATE GUIDE: How to Get an Urgent Loan with a Bad CIBIL

Why Avoiding Bad Debt is the Ultimate Financial Strategy for 2026 Why Avoiding Bad Debt is the Ultimate Financial Strategy for 2026 The Indian economy

Your Guide to Bad Credit Loans in India 2026: Fast Financing, Future Proofing | Omozing 🚀 Your Guide to Bad Credit Loans in India 2026:

Get Swift Loan Approval: Why a Co-Applicant Can Be Your Fastest Route Empowering responsible credit access with smart financial insights from Omozing (Powered by Aparampaar

💰 Fix Your CIBIL Score – Debt-Free Guide | Omozing Credit Booster 💰 Fix Your CIBIL Score: The Debt-Free Guide for High-Salary Professionals Introducing Omozing

💍 United in Life, United in Finance | Omozing Loans 💍 United in Life, United in Finance: How Couples Can Build a Powerful Joint Credit

The following are the top 10 quick points on what to do when you have a CIBIL write-off: Here is how Omozing.com is a registered

The following are the 7 factors other than CIBIL score than CIBIL that may impact your loan approval and eligibility in India: 1. Income Financial

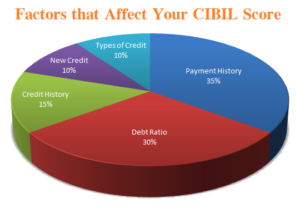

The following are the 9 hacks to improve your CIBIL score fast in India: 1. Pay Bills on Time Late or missed payments can have

The following are the 11 Factors that lead to low CIBIL Score in India: 1. Late or Missed Payments A history of late or missed

Rahul, a 26-year-old working in a MNC Bank in Bangalore, had a CIBIL score of 637 and was facing difficulty in getting a loan due

Your CIBIL report is a comprehensive document that contains information about your credit history, including information about your credit accounts, payment history, and credit inquiries.

In order to accomplish many of your goals and get through any emergency situations that may arise for many reasons, credit is crucial. Having a

A credit score is a three-digit figure, with a range of 300 to 900 with 900 being the highest possible score. The score evaluates a

A Business Credit Report, also known as a corporate credit report, is a detailed document that summarises an organization’s financial history based on data provided

What is a Company Credit Report? A CCR is a complex report describing the financial standing of an entity that was created using data from

1. How can I improve my CIBIL Score? You can improve your CIBIL Score by maintaining a good credit history, which is essential for loan

The following 4 are best Credit Score blogs from thousands of blogs on the web ranked by traffic, social media followers, domain authority & freshness. 1.

Even when you are paying your EMIs, bills, and other payments on time, it is never pleasant to notice a drop in your credit score.

Despite the fact that Credit Bureaus have been operating in India for over 15 years, a poll reveals that more than 80% of the public

The CIBIL score is one of the most important factors in obtaining the best credit cards, faster loan approval, and the ability to negotiate interest

Your credit score, also known as your CIBIL score, is a key component in deciding whether or not you will be accepted for a loan.

If a credit institution needs to establish a person’s credit status and assign them a credit score, credit history is an essential source of information.

If you want to take out a loan in the near future, maintaining a decent CIBIL score is one of the most important factors to

One of the most important markers of your financial wellness is your credit score. Unfortunately, in India, there is a lack of understanding about credit

A healthy CIBIL report and score increases one’s chances of getting a loan. Research data based on CIBIL (Credit Information Bureau (India) Limited) data analysis