Top 5 Legal Tips to Get Your House Vacated if Tenants Refuse to Leave in India (2025 – 2026 Guide)

Top 5 Legal Tips to Get Your House Vacated if Tenants Refuse to Leave in India (2025 – 2026 Guide) 🧩 Introduction: The Landlord’s Dilemma

Top 5 Legal Tips to Get Your House Vacated if Tenants Refuse to Leave in India (2025 – 2026 Guide) 🧩 Introduction: The Landlord’s Dilemma

In today’s fast-paced financial world, access to quick cash is easier than ever — but at what cost? Payday loans promise instant approval, but often

Do’s for a Safe Loan with Omozing Reach Out Only Through Official Channels – Always use our official website or mobile app to contact Omozing.

In India, your credit score is a crucial number that can influence your financial opportunities. It impacts your eligibility for loans, the interest rates offered

In India, managing debt has become a common challenge for many, with individuals often juggling multiple loans and credit card dues. The rise in easy

In today’s fast-paced world, financial stability can be elusive, and unexpected expenses can arise when least expected. Payday loans have emerged as a quick solution

In today’s fast-paced world, financial stability can be elusive, and unexpected expenses can arise when least expected. Payday loans have emerged as a quick solution

Balancing career and finances are a multi-faceted challenge that many working women in India face. The evolving social landscape, the push for financial independence, and

In an era where instant solutions are often sought for financial needs, payday loans have emerged as a popular yet controversial option. With promises of

An entrepreneur in India has a choice of seven distinct company structures in which to launch their firm and a variety of strategies to utilise

A GST Surrogate Business Loan is a product that allows MSME entrepreneurs to obtain money based on their GST records. If you’re a small company

Microfinance is a type of banking that is offered to jobless or low-income individuals or organisations that would otherwise be unable to get financial services.

Invoice discounting also called Bill Discounting is a way in which a company can borrow short term funds from banks or financial institutions based on

D2C brands frequently produce, promote, sell, and transport their items directly to consumers, keeping the D2C model lean and lucrative. Their development has been phenomenal,

Not everyone is fortunate enough to inherit a well-established family company. Many people, particularly those who have started their own business, encounter challenges such as

1. Omozing.com Omozing helps make Smart Money Moves for a Lifetime. They strive to get lowest interest rates and best terms for your Online Applications

One can take business loan to start a new project, expand the current business to a new location, and buy new equipment, purchase office space

Individuals who wish to expand their business or fund a business idea can opt for a business loan offered by a number of reputed financial lenders. It

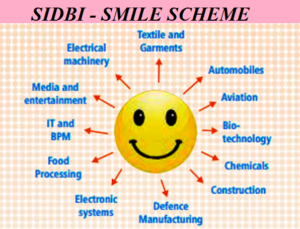

SIDBI Make in India Loan for Enterprises (SMILE) is intended to take forward Government of India’s ‘Make in India’ campaign and help MSMEs take part

Business Loan interest rate starts from 14.99% onwards per annum. However, other factors to influence the final commercial business loan interest rates decided by the lender

The interest you pay on your business is tax deductible that is generally subtracted from your gross income. As per the Income Tax Act, 1961,

Loans can be of different types, but the primary ones we would tackle through this article are around business and personal loans. The two loans

What is Revenue-Based Financing? Revenue-based financing, also known as royalty-based financing, is a type of capital-raising method in which investors agree to provide capital to

What is Merchant Capital? To some of you, “merchant capital” may sound like a foreign term. Others may recognize it as merchant financing, merchant cash

As we head towards 2022, the economy looks way more upbeat than what it did this time last year. As markets opened up, businesses across

Starting a small business is a massive but rewarding undertaking. Part of starting a small business is doing things in a way that makes the

A business health check is a look into the financial status of your business. It’s an easy way to find any potential issues, and gives

Funding is an extremely significant aspect in line with meeting the vision of a business. Funding and fundraising, both are fundamental modern business scenarios that

A cash flow loan is a small business loan that is based on your company’s cash flow. Unlike traditional asset-based business loans, a cash flow loan doesn’t