ULTIMATE GUIDE: Advance Salary Loan in India

ULTIMATE GUIDE: Advance Salary Loan in India ULTIMATE GUIDE: Advance Salary Loan in India How to Get Instant Salary Advance Loan Online — And How

ULTIMATE GUIDE: Advance Salary Loan in India ULTIMATE GUIDE: Advance Salary Loan in India How to Get Instant Salary Advance Loan Online — And How

How to Get an Urgent Loan with Bad CIBIL Score in India (2025) ULTIMATE GUIDE: How to Get an Urgent Loan with a Bad CIBIL

Why Avoiding Bad Debt is the Ultimate Financial Strategy for 2026 Why Avoiding Bad Debt is the Ultimate Financial Strategy for 2026 The Indian economy

Your Guide to Bad Credit Loans in India 2026: Fast Financing, Future Proofing | Omozing 🚀 Your Guide to Bad Credit Loans in India 2026:

Get Swift Loan Approval: Why a Co-Applicant Can Be Your Fastest Route Empowering responsible credit access with smart financial insights from Omozing (Powered by Aparampaar

💰 Fix Your CIBIL Score – Debt-Free Guide | Omozing Credit Booster 💰 Fix Your CIBIL Score: The Debt-Free Guide for High-Salary Professionals Introducing Omozing

💍 United in Life, United in Finance | Omozing Loans 💍 United in Life, United in Finance: How Couples Can Build a Powerful Joint Credit

Overlooking CIBIL Hurdles: How a Joint Loan Can Unlock the Best Rates and Highest Eligibility 🤝 The Power of a Joint Application The journey to

Personal Loans for Low or Bad CIBIL Score in India — A Complete Guide (2025 – 2026 Edition) 🌟 Can You Get a Personal Loan

A credit score is a numerical representation of a person’s creditworthiness, which is essentially anestimate of how likely they are to repay borrowed money. Credit

The following are the 11 Factors that lead to low CIBIL score in India:

Rahul, a 26-year-old working in a MNC Bank in Bangalore, had a CIBIL score of 637 and was facing difficulty in getting a loan due

The following are the 6 steps to take when you have a low CIBIL in India you get rejected for new loans: Read more related

The following are the 11 Factors that lead to low CIBIL Score in India: 1. Late or Missed Payments A history of late or missed

Rahul, a 26-year-old working in a MNC Bank in Bangalore, had a CIBIL score of 637 and was facing difficulty in getting a loan due

The CIBIL score is one of the most important factors in obtaining the best credit cards, faster loan approval, and the ability to negotiate interest

A bad credit score or no credit history are roadblocks when availing of a personal loan on favourable terms. Financial institutions do not advance loans

One of the most important markers of your financial wellness is your credit score. Unfortunately, in India, there is a lack of understanding about credit

A Personal Loan is an unsecured loan given to a salaried person with a decent credit score. A credit score is thus an important determinant

CIBIL Score for Personal Loans CIBIL score is a credit score provided by CIBIL, which is one of India’s leading credit information companies. The score

A credit score is a measure of your creditworthiness which is presented in a numerical format. It ranges between 300-900, 300 being the lowest and

The Indian economy is constantly growing with small businesses. Business loan seems like a dream come true. Sometimes, to avail a business loan in India, several

Let us understand that there is no separate defaulters list with the banks or credit bodies. Rather, credit companies maintain data pertaining to your repayment

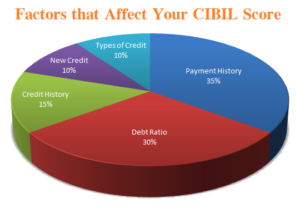

While each credit information company has its own proprietary algorithm to calculate an individual’s credit score, the most important elements of the score composition are

CIBIL aims to bring in more transparency to the loan approval process in the country, in that customer now have an understanding of the seminal

The following are the process of getting your Free CIBIL report online: 1. Visit Official CIBIL Page In this page you will be asked to create

The credit score is a three-digit numeric summary of your credit history, which is compiled from various financial institutions, lenders, and banks. The value ranges

Bad Credit Score can be improved/ rebuild even without Credit Cards. Primarily you need to repair your credit history before you see your Credit Score

Improve Credit Score Loans for Low CIBIL Score Personal Loans for low credit are an option for people whose credit reflects some financial missteps or